Accounts Receivable Are Best Described as

Payment methods you accept. The money owed to the company is called accounts receivable and is tracked as an account in the general ledger and then reported as a line on the balance sheet.

Accounts Receivable A R Asset Definition And Accounting Process

Accounts Receivable AR is the proceeds or payment which the company will receive from its customers who have purchased its goods services on creditUsually the credit period is short ranging from few days to months or in some cases maybe a year.

. When the accounts receivable of a company are sold outright to a company that normally buys AR the accounts receivable are said to have been. Gar received cash as a result of this transaction which is best described as a. By design it should be unambiguous.

Correctly managing your AR can help you reduce cash flow problems improve investment and run a successful business. Bank loan to be repaid by the proceeds from the accounts receivable c. Loan from Ross collateralized by Gars accounts receivable.

Select one or more. The word receivable refers to the payment not being realisedThis means that the company must have. Accounts receivable abbreviated as AR or AR are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for.

Equity Insurance Expense would appear on which of. Its the amount of money. Factoring of receivables is usually done on a.

This unpaid invoice describes the sale of goods or services the total amount the customer owes you and the due date for the payment. In this guide we take a deep dive into AR management to help you understand its importance. If a receivable account has a credit balance.

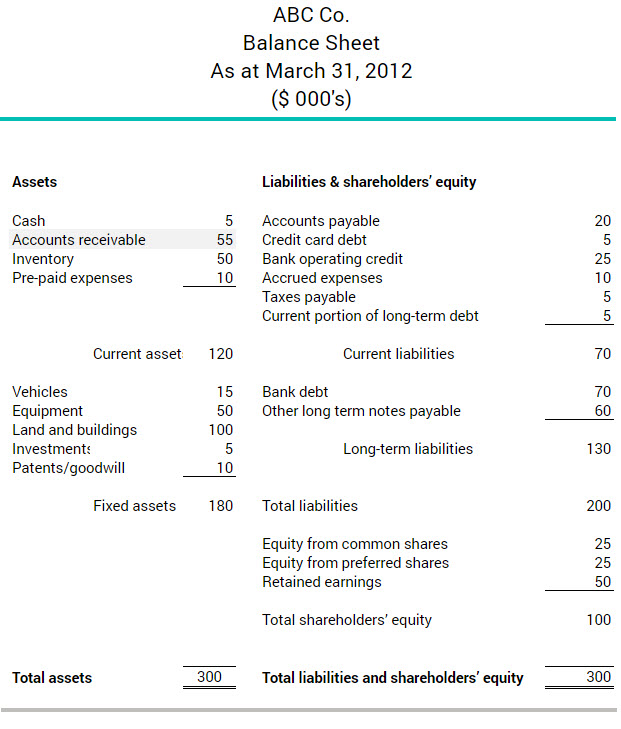

Loan from Ross to be repaid by the proceeds from Gars accounts receivable. Accounts receivable is shown in a balance sheet as an. Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount.

These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. Accounts receivable AR is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable describes money that your business is owed from its customers or clients.

Sale of the accounts receivable to the bank with risk of uncollectible accounts retained by the entity. In other words it is the amount that your customer owes you in respect of contractual obligations. Accounts receivables are also known as debtor trade debtors bills.

Accounts receivable AR are the amounts owed by customers for goods or services purchased on credit. If a company has delivered products or services but not yet received payment its an account receivable. Accounts Receivable is an asset account on your balance sheet that literally means money that has not yet been received such as something bought on credit or something that is billed basically any payment method except cash.

Definition of accounts receivables. Accounts receivable sometimes shortened to receivables or AR is money owed to a company by its customers. Assets of the company representing the amount owed by customers.

ABC received cash as a result of this transaction which is best described as a. Any activity or entries made into the account are called. An entity factored accounts receivable without recourse with a bank.

The institution to whom receivables are sold is known as factor. This money is typically collected after a few weeks and is recorded as an asset on your companys balance sheet. To ensure your customers are never left wondering and potentially withholding payment because of it never forget these pieces of information on your invoices.

Amounts that have previously been received from customers. Accounts receivables are listed on the balance sheet as a. The credit balance is offset with other receivable accounts with debit balances.

Liabilities of the company that represent the amount owed to suppliers. The term accounts receivable is the financial account a company uses to keep tabs on credit owed by customers and when it gets paid. Accounts receivable are documented through outstanding invoices which you as seller are responsible for issuing to the customer.

Bank loan collateralized by the accounts receivable. Accounts receivable invoicing best practice An invoice is a key piece of communication between a seller and a buyer. Sometimes referred to as AR accounts receivable is the accounting term for the money a business should receive from its customers from the sales of goods or services.

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. Accounts receivable refers to the amount that a company is entitled to receive from its customers for goods or services sold on credit. Loan from XYZ.

Accounts receivable are best described as. Receivables arising from sales to customers are best described as. Which of the following best describes accounts receivable.

Amounts that have previously been paid to suppliers. An account receivable is documented through an invoice which the seller is responsible for issuing to the customer through a billing procedure. Factoring is a common practice among small companies.

Definition and explanation. You use accounts receivable as part of accrual basis accounting. Sale of Gars accounts receivable to Ross with the risk of uncollectible accounts retained by Gar.

When an entity factored accounts receivable without recourse with a bank the transaction is best described as a. The invoice describes the goods or services that have been sold to the customer the amount it owes the seller including sales taxes and freight charges and when it is supposed to pay. The entity received cash as a result of this transaction which is best described as The transferor maintains continuing involvement All but one of the following are required before a transfer of accounts receivable can be recorded as a sale.

Youve probably used Accounts Receivable without even realizing it before. Finance questions and answers.

What Are Accounts Receivable Bdc Ca

Should Accounts Receivable Be Considered An Asset Billtrust

Awesome Account Receivable Resume To Get Employer Impressed Job Resume Samples Resume Examples Resume Objective Examples

Comments

Post a Comment